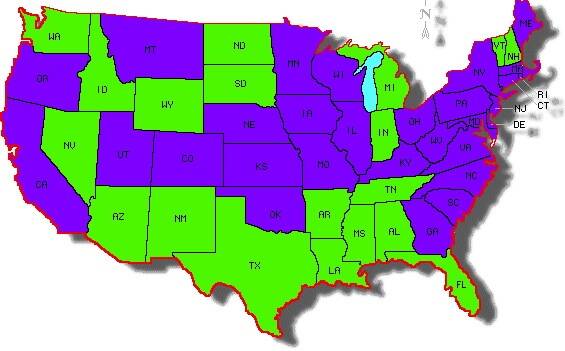

State governments shrunk a bit in 2012, according to data released last week by the Census Bureau (see press release or PDF report), with total revenue dropping by 1.8 percent and expenditures falling by 0.5 percent. But there were big differences among states in terms of how much they spent and how they got their money. As the map with this post shows (bigger version below), one dividing line, which somewhat follows the blue/red split in the United States, is between states that rely on individual income taxes and those that rely more on sales taxes (which are a bigger burden on low-income households).

Some states increased spending in 2012, led by North Dakota (up 15.7 percent), Maryland (up 10.2 percent), and Nevada (up 5.7 percent). The biggest drops were in California (down 5.4 percent) and New Mexico and South Carolina (both down 5.0 percent). Education accounted for 36 percent of all state spending, ranging from 46 percent in Georgia and Indiana to 25 percent in Alaska. “Public welfare” accounted for 30 percent of all state spending and exceeded education spending in Connecticut, Illinois, Maine, Massachusetts, New York, Pennsylvania, Rhode Island, and Tennessee. Except for Tennessee, these are states with relatively low birth rates and population growth.

More spending highlights from the Census report:

•“The leading states in spending on public health and hospitals, measured as a percentage of general expenditures, were Kansas (12.4 percent), Hawaii (12.3 percent) and Missouri (11.8 percent).”

•“State government spending on public welfare was greater than 30 percent of general expenditures in 14 states, led by Tennessee (38.4 percent), Maine (36.6 percent) and New York (36.2 percent).” The shares are lowest in Wyoming (15.2 percent) and Utah (19.2 percent).

•“The leading states in highway spending, measured as a percentage of general expenditures, were North Dakota (19.0 percent), South Dakota (16.7 percent) and Montana (13.9 percent).” At the other end of the scale is New York (3.26 percent).

As for where the money comes from, states get an average of 31.6 percent of their general revenue from federal grants (from 20 percent in Alaska to 45 percent in Mississippi). For the rest, each state has its own formula.

On our map, purple states get more revenue from income taxes (on individuals and corporations), and green states get more revenue from sales taxes. Alaska is not counted because it gets less than 10 percent of its revenue from either source, having the good fortune to be able to squeeze money from oil companies. North Dakota, New Mexico, and Wyoming also get significant revenue from severance (or extraction of natural resources) taxes.

Conservative states tend to rely more on consumption taxes, which can be a bigger burden on low-income households that have little money left to save or invest. But sales taxes are not the same everywhere. Alabama, New Hampshire, and Vermont get more revenue from targeted taxes (including “sin taxes” on items like cigarettes and alcohol) than from across-the-board levies. (New Hampshire doesn’t have a general sales tax at all.) The states most dependent on sales taxes are Nevada (48 percent of general revenue), Washington (42 percent), Florida (38 percent), and Hawaii (36 percent), and Texas (35 percent). Nevada, Florida, and Hawaii are presumably outliers because it’s irresistible to make money off tourists. Washington state is more of a puzzle. In fact, the starkest contrast between neighbors is Oregon (which has no general sales tax) and Washington (which has no income tax), though the states are otherwise very similar politically.

The states that rely the most on revenue from individual income taxes are Connecticut (30 percent), California (28 percent), Massachusetts and Oregon (27 percent), and New York and Virginia (26 percent). Virginia is kind of an odd man out here, but its tax rates aren’t unusually high; it can collect so much because it has so many affluent residents.