Income inequality is already a major issue in the 2016 presidential race, and Vermont Sen. Bernie Sanders called it “the great moral issue of our time” in his kick-off speech for the Democratic nomination on Tuesday. But a new study finds that efforts at the national level to narrow the wealth gap are already being undermined by many state tax codes.

“State tax systems, on average, tend to increase income inequality slightly,” write three researchers at the Federal Reserve Bank in a 45-page report released last week, partially offsetting the federal tax code’s “mitigating” effects on inequality—effects achieved through a progressive income tax and an array of benefits for lower-income households, such as the Earned Income Tax Credit. In contrast to the federal tax code, many states have flat income taxes or no income taxes at all, and many rely more on sales taxes that disproportionately burden low-income households. (See “State Tax Burden Shifts From High-Income Households to Everyday Shoppers,” based on the latest Census data.)

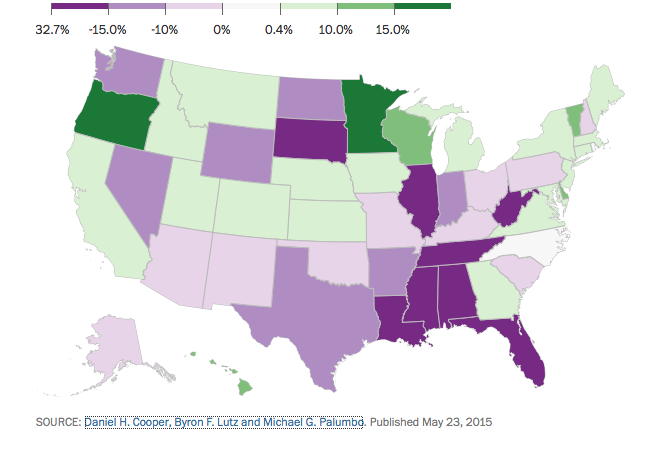

The Federal Reserve report, which uses the term “compression” as a synonym for reducing income inequality, is a tough read for those not familiar with statistical analysis, but it does name names: “States with relatively progressive personal income taxes, such as California, Minnesota, New York, and Oregon, have the highest tax compression, while states without a broad-based income tax, such as Florida, New Hampshire, South Dakota and Tennessee, are in the group of states with the least overall tax compression.”

The two states that do the most to restore income inequality are in the South: “the tax policies of Tennessee and Mississippi reverse around one-third of the compression caused by federal taxes.” Mississippi not only has one of the highest state sales taxes in the nation (7 percent), it is one of only two states, with Alabama, that does not exempt food from sales taxes or offer a tax rebate to low-income households for taxes paid on food. Tennessee has a general sales tax of 7 percent but taxes food at 5 percent.

Minnesota and Oregon, the two states with tax codes that do the most to reduce income inequality, do not tax food at all, though Minnesota otherwise has a 6.9 percent general sales tax.

The map above is from the Washington Post, which used the Federal Reserve data to show which states, as its headline puts it, “rob from the poor and give to the rich,” with purple indicating regressive tax codes and green indicating tax codes that help lessen income inequality. The Post’s Christopher Ingraham writes, “There’s no question that state-level laws can make a big deal of difference when it comes to income and wealth distribution, particularly for lower-income families.” He notes that in addition to general sales taxes, gas taxes “serve to moderately increase inequality” (because everyone pays the same rate) and that “states that provide a version of the earned income tax credit can see a big reduction in inequality.” (See the map below, from the Center on Budget and Policy Priorities, for the 25 states that offer this credit to wage-earning households.)

In general, Democratic states have policies that strengthen the federal tax code’s attempts at reducing income inequality, while Republican states oppose what could be called wealth redistribution (however meager). Still, heavily Democratic Illinois has one of the most regressive tax codes, with a flat income tax rate of 3.75 percent and relatively high sales taxes, while the Republican states of Georgia and Idaho are among the states that increase the inequality-reducing effects of the federal tax code.